Whether you are planning to work, invest, or start a business in Canada, our tax specialists can help you successfully navigate our tax laws.

Understanding Canadian Tax Obligations for Non-Residents

Much of the tax payable by non-residents is collected through Canadian withholding taxes.

Both income and capital gains are taxable in Canada. All business, property, and employment income, whether active or passive, falls within the scope of Canadian taxation. Fifty per cent of capital gains are included in income, and, accordingly, only 50% of capital losses may be offset. Capital losses can only be offset against capital gains.

If you conduct business in Canada, you are generally subject to taxation on Canadian-source income, such as:

- Income from a business carried on in Canada

- Income from an office or employment in Canada

- Capital gains on the disposition of property, known as “taxable Canadian property”

- Income of a passive nature received from Canadian residents (e.g., dividends, rent, royalties)

Our Cross Border Tax Compliance Services:

Our expert corporate tax specialists make complying with international tax laws simple. We provide the following services:

- Corporate Tax Filings: Preparation and filing of T2 tax returns for non-resident businesses.

- Elective Non-Resident Tax Returns: Filing for non-residents with Canadian-sourced income.

- GST/HST Returns: Filing for non-resident businesses and real estate rental property owners.

- Non-Resident Tax Slips: Preparation of NR4, NR4 Summary, T4A-NR slips, and T4A-NR Summary.

- NR6 Tax Forms: Assistance with reducing withholding taxes on Canadian rental income earned by non-residents.

- Real Estate Tax Compliance: Preparation of Form T2062 clearance certificates and tax returns for the sale of Canadian property by non-residents.

- Tax ID & Withholding Accounts: Assistance with Form T1261 for obtaining a non-resident tax number.

- CRA Representation & Audit Support: Handling tax disputes and communications with the Canada Revenue Agency.

- Cross-Border Planning: Treaty applications, transfer pricing strategies, and dual-taxation avoidance.

Are you ready to learn more about Canadian Tax Compliance?

Whether you are planning to work, invest, or start a business in Canada, our tax specialists can help you successfully navigate our tax laws.

Corporate Tax Planning for International & Cross-Border Businesses

We also provide our corporate clients with consultancy services that include:

- Incorporation & Business Setup: Guidance on structuring your company for tax efficiency in Canada.

- Buying or Selling Canadian Assets: Understanding the tax implications of acquiring or selling businesses and properties.

- Temporary Worker Taxation: Ensuring compliance for employees working in Canada.

- Voluntary Disclosure & CRA Audits: Support in resolving tax discrepancies and audits with the Canada Revenue Agency.

Why Global Companies Trust SB Partners

- CRA-Approved Expertise: Our CPAs hold Advanced International Tax Certifications and maintain 99.8% filing accuracy.

- Industry-Specific Knowledge: Specialized workflows for tech startups, manufacturing, and real estate investors.

FAQs

The following items count as taxable Canadian property:

- Real property situated in Canada.

- Assets used in a business carried on in Canada.

- A share of a private corporation resident in Canada where more than 50% of the fair market value of the share is derived (or was derived at any time in the previous 60-month period) from real property in Canada, Canadian resource properties, timber resource properties, or options in respect of any such property.

- A share of a public corporation (or mutual fund trust) where at any time in the previous 60-month period (a) the holder held more than 25% of the issued shares and (b) more than 50% of the fair market value of the share (or unit) was derived from real property in Canada, Canadian resource properties, or timber resource properties.

- Options in respect of any of the properties listed above.

- Property deemed by the Income Tax Act (ITA) to be taxable Canadian property.

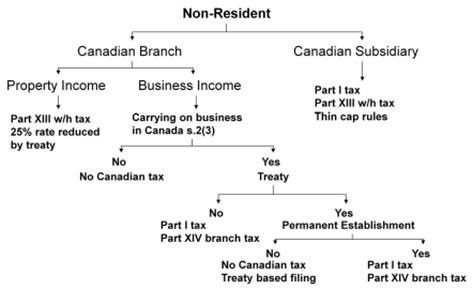

To know what your tax status is, we’ve put together a helpful tax status decision tree:

photo credit: CPA Canada

A non-resident corporation will be subject to income tax at normal corporate rates on profits derived from carrying on a business in Canada. However, Canada’s tax treaties generally restrict taxation of a non-resident business income to the portion allocable to a Permanent Establishment (“PE”) situated in Canada.

In addition, a special 25% ‘branch tax’ applies to a non-resident’s after-tax profits that are not invested in qualifying property in Canada. The branch tax is essentially equivalent to a non-resident WHT on funds repatriated to the foreign head office. In the case of a corporation resident in a treaty country, the rate at which the branch tax is levied may be reduced to the WHT rate on dividends prescribed in the relevant tax treaty (generally 5%, 10%, or 15%). Some of Canada’s treaties prohibit the imposition of branch tax or provide that branch tax is payable only on earnings in excess of a threshold amount. The branch tax does not apply to transportation, communications, and iron ore mining companies. Nor does it apply to non-resident insurers, except in special circumstances.

Whether or not a treaty applies, a non-resident corporation that has a PE in Canada may be subject to federal and provincial capital taxes (in Canada, only financial institutions are subject to capital tax).

Canada’s tax treaties generally provide that the business profits of a non-resident corporation are not subject to Canadian tax unless the non-resident corporation carries on business in Canada through a PE situated in Canada and the business profits are attributed to that PE. Canada’s tax treaties may also restrict the imposition of branch tax to situations where the non-resident corporation carries on business in Canada through a PE situated in Canada and/or limit the applicable branch tax rate. While the wording of tax treaties varies, a PE generally is defined as:

A fixed place of business through which the business of the non-resident corporation is wholly or partly carried on.

A place of management, a branch, an office, a factory, and a workshop; a mine, an oil or gas well, a quarry, or any other place of extraction of natural resources; a building site, construction, or assembly project that exists for a specified period.

A dependent agent or employee who has and habitually exercises an authority to conclude contracts in the name of the non-resident corporation.

In some circumstances, a Canadian PE may also arise where services are rendered in Canada and certain requirements (e.g. relating to the duration of the services) are met.

The Canadian domestic definition of PE (federal and provincial/territorial) generally mirrors the above.

Under the Income Tax Act, a corporation incorporated in Canada (federally or provincially/territorially) will be deemed to be resident in Canada. A corporation not incorporated in Canada will be considered to be resident in Canada under Canadian common law if its central management and control are exercised in Canada. Where a corporation’s central management and control is exercised is a question of fact, but typically it is where the board of directors meets and makes decisions, provided the board takes action.

A corporation incorporated outside of Canada but with its central management and control situated both in and outside Canada will be deemed to be a non-resident of Canada if it qualifies as a non-resident of Canada under treaty tie-breaker rules.

If a company incorporated in Canada is granted Articles of Continuance in another jurisdiction, the corporation is deemed to have been incorporated in the other jurisdiction and not to have been incorporated in Canada. However, a company incorporated in Canada that is continued into a foreign jurisdiction may still maintain residency in Canada under the common law principles for the determination of residency (i.e. central management and control discussed above). Similarly, a foreign corporation will become resident in Canada if it is continued in Canada or is a predecessor corporation of an amalgamated corporation that is resident in Canada.

The federal and provincial corporate tax rates vary, depending on the industry and type of corporation involved. Federal income taxation is levied on resident corporations on their worldwide income.

Generally speaking, the combined federal and Québec/Ontario rate for non-Canadian-controlled private corporations is 26.5% for active business income. Separate rates exist for general active business income, manufacturing and processing income, and investment income and for Canadian-controlled private corporations. A non-resident corporation pays tax on income earned in Canada, subject to certain tax treaty concessions.

To find the most up-to-date rates visit: Corporation tax rates – Canada.ca

SB Partners works with a variety of businesses from large corporations to SMEs and owner-managed private enterprises. Whether you are starting from scratch or looking for change, our team of industry experts can support you and your business.